Unlocking Los Angeles Factoring Company Benefits!

Is your Los Angeles business trying to increase cash flow and growth? You’re in the correct place! Los Angeles factoring companies may be the answer. In this blog post, we’ll discuss factoring, how it works, its benefits, some of LA’s top factoring companies, key considerations when choosing a provider, and common misconceptions to help you make an informed decision that grows your business. Jump in!

Workings of Factoring

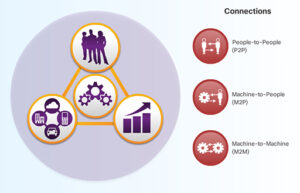

Selling accounts receivable to a factor improves cash flow for firms. How it works:

Businesses invoice clients after delivering products or services. Instead of waiting for payment, the firm sells the invoice to a factoring company at a discount. The factoring provider gives the business 80–90% of the invoice amount upfront.

The factor receives payment from the client when the invoice is due, deducts its fees, and returns the rest to the firm. This arrangement allows organisations to quickly meet operating expenditures or engage in development potential without long payment periods.

Factoring gives organisations rapid cash based on outstanding invoices while outsourcing credit supervision and collections to financial institutions.

Businesses Benefit from Factoring

Businesses profit immensely from Los Angeles factoring services. Cash flow is a big benefit. Businesses might get cash from the factoring provider before customers pay invoices.

This immediate cash infusion lets enterprises satisfy their financial obligations without waiting for payment conditions. Factoring also reduces the need for firms to take on debt or take out expensive loans for operating needs.

Factoring improves flexibility and scalability. Business financial needs change as it expands. Factoring allows firms to capitalise on growth prospects without being bound by standard loan restrictions.

Working with a trustworthy Los Angeles factoring firm may help improve credit control and decrease bad debt risk. By outsourcing accounts receivable management, firms can focus on core operations while specialists handle collections and credit checks.

Today’s competitive market requires firms to have financial security, which the appropriate factoring partner can provide.

Considerations for Choosing a Factoring Company

Choosing a Los Angeles factoring business involves numerous important considerations. Find a firm with industry knowledge. Specialised expertise may streamline and customise the procedure.

Consider the factoring company’s cost structure. Understand their costs, tariffs, and extra charges. Financial arrangements require transparency.

Also vital is client service. Choose a factoring firm that communicates well and gives great help during funding. Your team should be responsive to your questions.

Before hiring a factoring business, read the contract. Before continuing, make sure you understand all agreement terms.

Common Factoring Misconceptions

Several factoring myths cause organisations to ignore this crucial finance alternative. Factoring is not just for tiny or failing enterprises, as many believe. Factoring helps firms of all sizes optimise cash flow and working capital.

Another myth is that factoring is hard and time-consuming. Reputable Los Angeles factoring companies streamline the procedure, making it fast and easy for businesses needing instant financing. Some feel factoring may impair their customer connection due to third-party participation. Invoice factoring improves financial stability, which many clients enjoy.

Misconception: factoring is more expensive than standard loans. While invoice factoring has costs, the benefits of immediate cash and decreased risk make it cost-effective for many organisations.

Conclusion

Los Angeles factoring firms help businesses optimise cash flow and swiftly access working capital. Factoring gives firms financial stability, flexibility, and decreased late payment risks. Rates, customer service, industry experience, and contract conditions are important when choosing a Los Angeles factoring firm.

Factoring may help your business thrive with the right partner. Don’t allow myths stop you from investigating this funding option that might boost your business. To maximise factoring benefits for your business, choose a reliable Los Angeles factoring provider that matches your aims.

Post Comment